People have been obsessed with the year 2020. It’s a new decade, and, as a side benefit, 2020 makes it really simple to come up with ‘clever’ resolutions. “I am embracing this 2020 vision “. It’s so lame that it hurts a little. But, below is something that isn’t lame, nor painful; a financial checklist!

In this blog post, we put together a list of all things that should be on your to-do list for 2020. For more information on any of the topics, click on the headings to be redirected one of our more in depth blog posts on the subject.

Before getting into the rest of the article, if you enjoy our weekly content click the follow button. Also if you could like this post and comment down below it would be much appreciated. This helps us to know that our advice and perspective is valued. Thanks!

Load Up Your TFSA

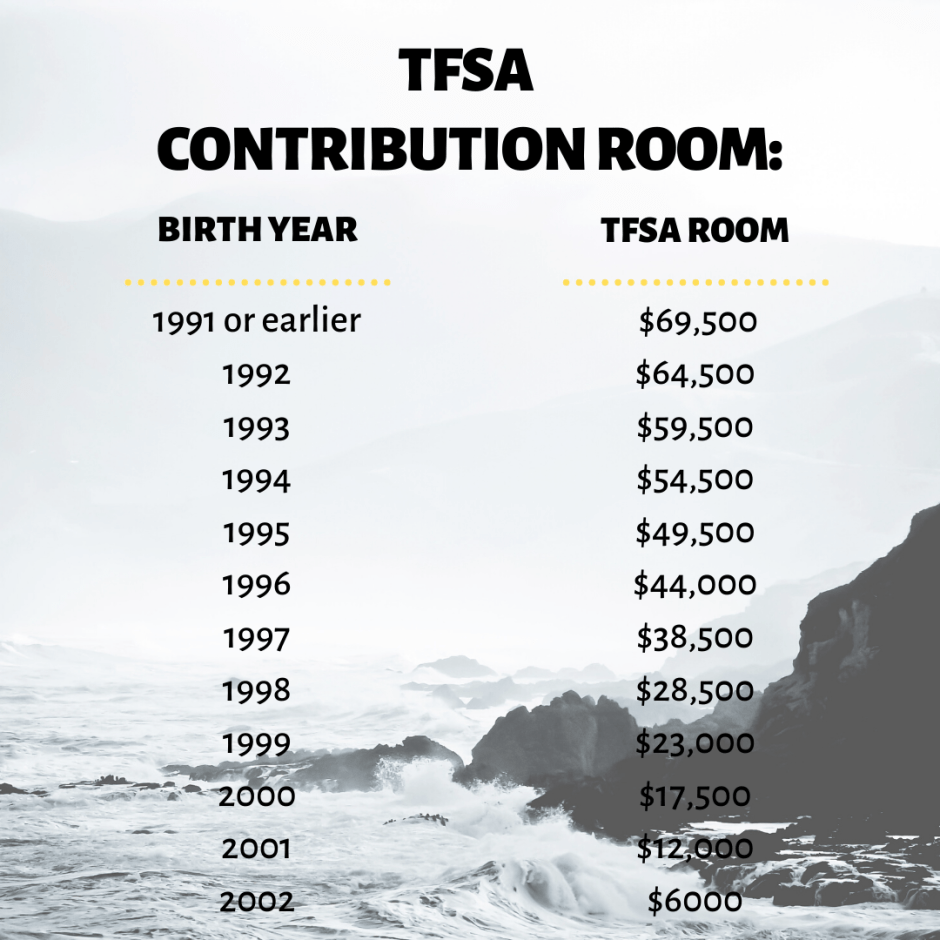

The first thing on your financial checklist should be loading up your TFSAs. On Jan. 1st we were granted an additional $6000 of new contribution room. Enjoy the gift, embrace the gift. Load yours up today. Below is a table depicting the amount you can contribute based on your year of birth:

Quick Tip: Make sure that your spouse is listed at the Survivor Holder, NOT just the beneficiary. It’s simple to change and saves a huge headache and potential income tax complication if you are to predecease.

Get a POA & Will

We will continue saying this until all of our readers have one. A POA and Will are an absolute necessity for anyone over the age of 18. A health care directive is also important. Spend the money so your loved ones can pay your bills. Seriously.

Fill Up Your Child’s RESP

Financial checklist item number three revolves around RESPs. Remember, the government gifts each of your children with a 20% grant up to $2500 of contributions each year. Make it your goal this year to put away $2500 for their future, and receive a 20% ($500) grant.

Furthermore, maybe you didn’t contribute when your kids were younger. Luckily, if there is unused grant money, you can contribute up to $5,000 per beneficiary in a year to receive a 20% match. Remember this only applies if there are unused grants.

Additionally, make sure that the beneficiaries are set up correctly, and always make sure that you open a family RESP instead of an individual one. This provides more flexibility if one child decides not to go to school or doesn’t use up their full allotment.

Meet With a Financial Planner

Knowing what to do with your money is important. If we don’t have a solid plan, we are more likely to blow the dough. Close to 40% of Canadians surveyed feel their financial futures are not in control. Seeking out the professional advice of a trusted advisor can help mitigate the stress and anxiety around your financial future.

An international HSBC study, The Future of Retirement, in 2011 showed that those with financial plans accumulated nearly 250% more retirement savings than those without a financial plan in place. Furthermore, nearly 44% of those who have a financial plan in place save more money each year for retirement. Get one. You won’t regret it.

If you like to make an appointment with us, just fill out this form!

Make Your 2019 RRSP Contributions

If you haven’t done so already, contribute to your RRSP by March 2nd to enjoy the tax deductions on your 2019 returns. We suggest RRSP contributions for anyone with taxable earnings of $95,000 or more. Lower incomes may still benefit from RRSP contributions but you should seek out advice on its efficiency.

Want to level up? Make RRSP contributions (18% of your 2018 taxable income) and use the tax return money to load up the additional $6000 of TFSA room you were given for 2020.

Convert Your RRSPs to RRIFs & Apply for CPP/OAS

If you are celebrating your 71st Birthday this year, remember that you need to convert all your RRSPs to RRIFs by year-end. If you aren’t turning 71 this year, stay on course, and keep filling those saving vehicles.

Once you have converted RRSPs to RIFs there is a minimum that must be withdrawn. However, maybe you don’t need to extra income yet. A great option, in this case, is to use that additional income to max out your TFSA.

Want to retire early? You can apply for CPP as early as age 60, and OAS as early as age 65. You should contact your financial planner to help coach you through making the decision that’s right for you.

Turn Off The News

2020 may come with some economic volatility. Turn off the news and move forward with your day. Don’t like what you hear? We offer the same advice – save some extra money, turn off the news, and move forward. The economy is booming right now. That could change, but it might not. If you’re prepared with an adequate emergency fund, don’t sweat the future.

Review Your 2019 Budget/Create 2020 Budget

A financial checklist wouldn’t be complete if we didn’t mention budgets. We always recommend that people take the time to do an annual review of their finances. This is something that we incorporate with our financial planning clients because we truly believe in its power.

Thinking about your 2019 finance goals, and evaluating how you did, is a great way to set goals for 2020. Celebrate the victories and look at areas that could use improvement. Review your long-term financial goals and goals you have for the next year. Breaking these “goals” into bite size pieces will help keep you focused and motivated.

Check your Credit Score

Soft-credit check:

An inquiry that occurs when a lender that has an existing relationship with you, checks your credit report as a soft background check. Credit cards companies do this most often when they want to offer you increased credit limits. Soft inquiries can occur with or without your permission, but don’t worry – they won’t affect your credit score.

If you would like to check your credit score, the two most reputable sources are Equifax and Transunion. Both of these sources do have a cost. There are also free services out there, most notably, CreditKarma. Like stated above, checking your own credit score won’t hurt it because it is a soft inquiry.

File Your Taxes

Don’t forget to file your taxes by April 30th. Being negligent in your tax filing can result in two outcomes, neither of which are particularly enjoyable.

1) If you owe the government additional tax money, but do not file, you will be charged interest on the sum owed.

2) If you are supposed to get a tax return, but don’t file, you are giving the government a tax free loan of the sum they owe you!

Either way, be prudent and get those tax returns filed. Before April 30th.

Conclusion

We hope this list allowed you to think about some of the financial actions that should be included in your 2020 financial checklist. Can you think of anything we forgot? – Comment below. Need help achieving one or multiple things on the list? Again, comment below, or contact us.

We are also on social media now, click the social icons in the top right corner and follow us on Facebook, Instagram, and LinkedIn.

Share your thoughts with us!

If you enjoy the forbeswealthblog content please like, comment, and share it with your friends. Also, click the follow button on the right side to follow our blog for great original content every week.

Visit: www.forbeswealth.ca

Disclaimer: This Forbes Wealth Blog is for informational purposes only and does not constitute financial, legal, or tax advice of any kind. Please consult your legal, accounting, tax, investment, banking, and life insurance professionals to get precise advice relating to your particular situation before acting upon any strategy